Investment Process -

there are no short cuts to success

Investment Process

There are no short cuts to success

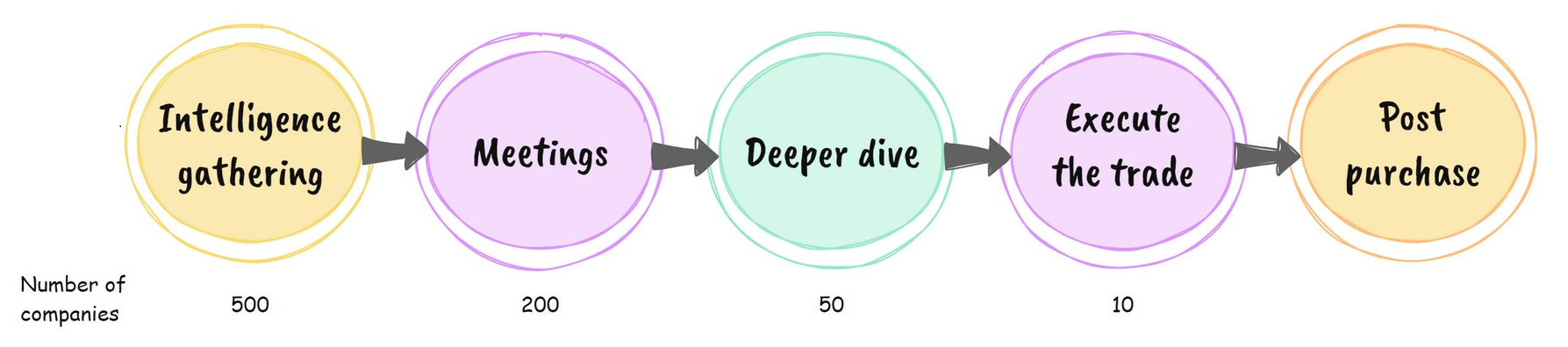

- Our default thinking is long term and our self-imposed process is intentionally rigorous and long-winded

- Every year, we meet hundreds of companies but purchase just a few. We think like owners and we act like owners – in other words we do not Buy on Monday to Sell on Wednesday

- Our Fund is one of UK’s oldest funds and is living proof that research-focused stock picking works… but it often takes time for good companies to reach valuations they deserve