Confirmation Bias

As humans, each of us has subconscious biases. These biases create blind spots and errors, costing us real cash. Perhaps we cannot completely eliminate our biases but we can work towards recognizing, acknowledging, learning, and ultimately reducing them. If done successfully, we will improve our decision-making and financial results.

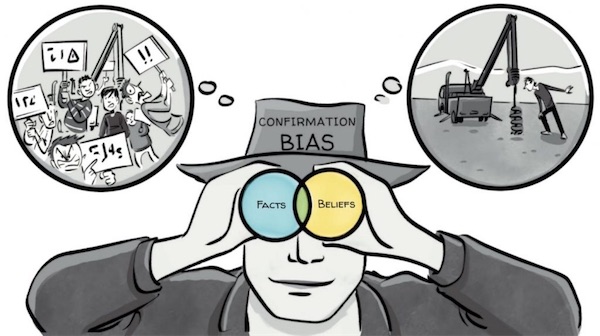

Confirmation Bias

Confirmation bias is the tendency for investors to actively seek out information that supports their preconceived views while totally ignoring any (and even all) contradictory information. For example, an investor may have purchased shares in a company in anticipation of the launch of an exciting new product and will avidly read any articles they can find on the benefits of this new product. However, they will actively ignore any articles on topics such as the strength of competitors’ products or potential delays or technical difficulties associated with the product launch. This “blinkers on” approach can lead to the incorrect assessment of downside risk and ultimately loss of capital.

Potential solution: Deliberately seek out information that challenges your original investment and/or discuss your views with trusted friends who have views that do not exactly agree with yours. Your open-mindedness and ability to assimilate new information objectively and dispassionately should do wonders to your bank balance.

It is important to note that not all investors will be susceptible to exactly the same biases. We are all perfect (and imperfect) in our own special way! You are the best judge to identify which biases have the better of you. Recognize these biases when you are exhibiting them and deliberately make an attempt so they do not cloud your investment judgment.